Ethereum's 2026 roadmap: what Glamsterdam actually does (and what it doesn't)

Ethereum is getting two major upgrades in 2026. If you’ve seen the “10,000 TPS” headlines, I want to be direct with you: that’s not what these upgrades deliver. Not this year. Probably not for a few years after that either.

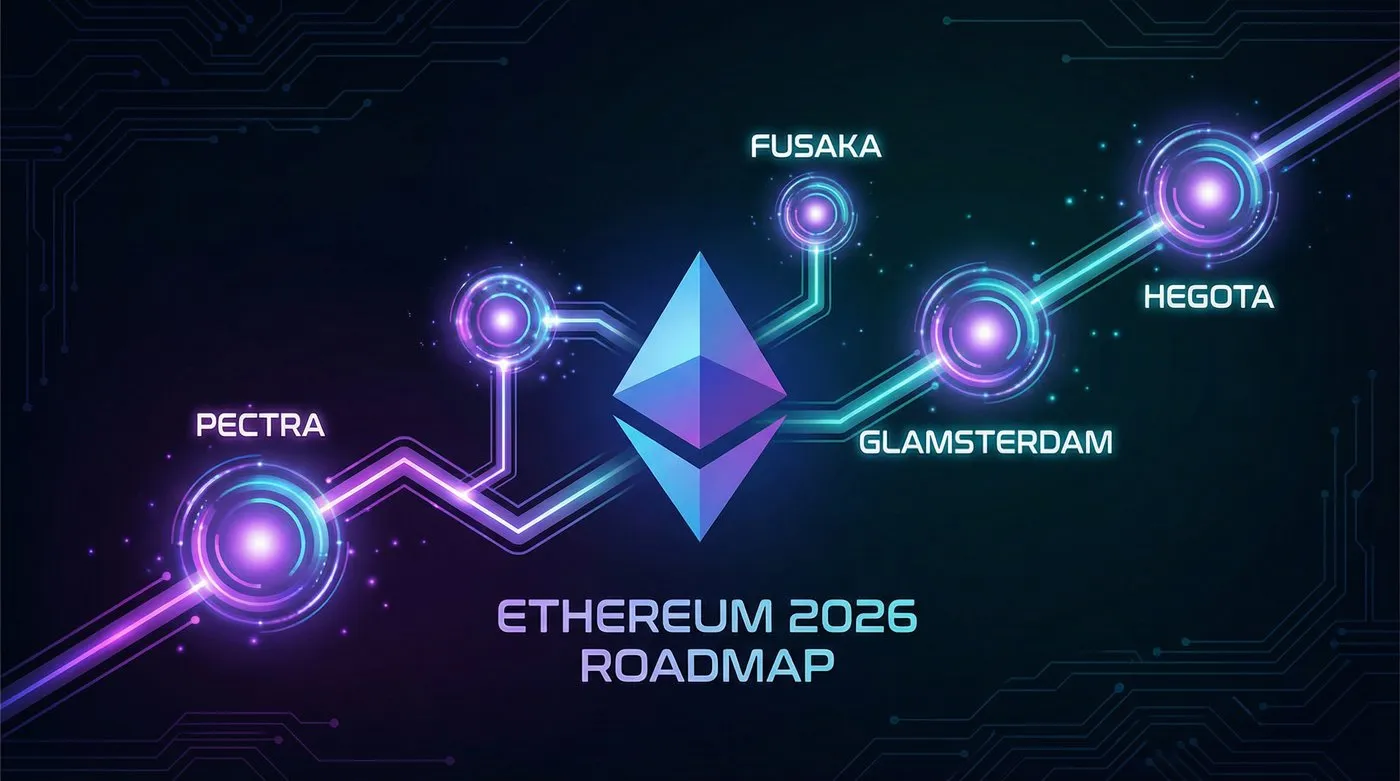

What Glamsterdam and Hegotá actually do is less flashy but more interesting. Ethereum is getting parallel transaction processing, a long-overdue reform of its block production pipeline, and a censorship resistance mechanism that could matter a lot for decentralization. Together, they continue a methodical engineering project that’s been running since the Merge in 2022.

Here’s what’s actually coming and when.

Where Ethereum is now

Four upgrades have shipped since the Merge. Each unlocked something the next one needed.

Pectra landed in May 2025, the most feature-dense Ethereum upgrade ever at 11 separate improvements. Two changes stand out. EIP-7702 lets regular wallets temporarily behave like smart contracts, enabling gasless transactions, transaction batching, and social recovery without migrating to a new wallet type. That’s a genuine UX leap for everyday users. EIP-7251 raised the maximum validator balance from 32 ETH to 2,048 ETH, which means large stakers no longer need to spin up hundreds of separate validator instances. The validator set gets smaller and less noisy.

Then Fusaka shipped in late 2025, and most people missed it. The headline feature was PeerDAS (EIP-7594), which doubled blob capacity for L2 rollups from a max of 9 per block to a target of 14 and maximum of 21. More importantly, it introduced a mechanism for adjusting blob counts without a full hard fork. Future blob scaling can now happen through smaller targeted updates rather than waiting for a full network upgrade cycle. That’s a quiet but meaningful change in how Ethereum scales its L2 ecosystem.

Glamsterdam: two big ideas

Glamsterdam is the next scheduled upgrade, targeting mid-2026. June is aspirational. September is more realistic given where development stands.

The two headliner features address different layers of Ethereum’s architecture.

Block-Level Access Lists (EIP-7928) fix how Ethereum processes transactions. Right now, every transaction runs in a single queue, one after another. A single slow transaction stalls everything behind it. BALs solve this by including a pre-computed map in each block header that tells every node exactly which accounts and storage slots each transaction will touch. With that map, nodes can run non-conflicting transactions across multiple CPU cores in parallel.

One developer working on the spec called sequential disk access “the biggest bottleneck we have.” BALs also let nodes preload all the required data from disk before execution starts, eliminating the read-write bottleneck that slows things down today. The result: Ethereum can push through significantly more transactions without proportionally increasing validation time. Gas limit increases that would have been dangerous to propose before become reasonable afterward.

Tomasz Stańczak, Ethereum Foundation co-director, expects the gas limit to reach 100 million in the first half of 2026 and double to 200 million after Glamsterdam ships. Gary Schulte, a Besu client engineer, put it more cautiously: “I think in 2026, I would expect to see 100 million fairly soon. Anything beyond that is probably just too speculative to consider.” The truth is probably somewhere between those two, and it matters because gas limit plus parallel execution is how Ethereum gets from ~30 TPS today toward hundreds of TPS on L1 by year’s end.

Enshrined Proposer-Builder Separation (EIP-7732) tackles a different problem. About 90% of Ethereum blocks today pass through MEV-Boost, an off-chain relay system operated by a small number of companies. Validators outsource block building to specialized builders who maximize MEV extraction, and the whole thing runs through private relays that nobody has to answer to.

ePBS bakes this separation directly into Ethereum’s protocol. Builders compete on-chain. Proposers choose from verified bids. No relay intermediary required. The protocol enforces the commitments.

There’s a secondary benefit. ePBS gives block builders approximately 7 additional seconds per slot to assemble a block and generate ZK proofs. Ladislaus von Daniels, an Ethereum Foundation researcher, noted that this “makes opt-in zkAttesting much more incentive compatible for validators.” More ZK-attesting validators means larger blocks can be verified safely, which feeds back into the gas limit story.

The catch: as of January 2026, the ePBS devnet hadn’t started yet. BALs was running. ePBS is more complex. That’s partly why the June date is aspirational rather than firm.

Hegotá: censorship resistance

The second 2026 upgrade is Hegotá, a portmanteau of Heze (a star name in the IAU catalog) and Bogotá. The earlier name “Heze-Bogota” stuck around in some coverage but the canonical version is Hegotá.

The leading headliner candidate is FOCIL (Fork-Choice Inclusion Lists, EIP-7805). The headliner decision was due February 26, 2026, so it should be confirmed by the time you read this.

FOCIL is a mechanism for ensuring transactions can’t be quietly excluded by validators who might prefer to ignore them. A committee of validators publishes a list of transactions that must appear in the next block. Proposers who skip them face consequences under the fork-choice rules. As one developer explained it: “That is a censorship resistance mechanism that ensures that if at least you have part of the network that’s honest… then you’re going to have your transaction included at some point.”

This isn’t about ordinary spam filtering or fee prioritization. It’s about preventing a situation where coordinated validators could systematically exclude specific addresses or transaction types, which becomes more relevant as regulatory pressure on Ethereum increases.

If Glamsterdam ships around Q3 2026 and the usual 6-9 month gap applies, Hegotá arrives somewhere between Q4 2026 and early 2027.

The 10,000 TPS question

In February 2026, Vitalik Buterin posted a pointed correction on X: “If you create a 10000 TPS EVM where its connection to L1 is mediated by a multisig bridge, then you are not scaling Ethereum.”

He followed up: “This may be doing the right thing for your customers. But it should be obvious that if you are doing this, then you are not ‘scaling Ethereum’ in the sense meant by the rollup-centric roadmap.”

His point is important. The 10,000 TPS figure is a long-term target for Ethereum as a combined L1+L2 system, not a 2026 deliverable, and not achievable through just any fast EVM chain. The throughput only counts if it’s backed by Ethereum’s full security guarantees: validity, censorship resistance, finality.

Realistic honest timeline: Glamsterdam brings L1 toward hundreds of TPS. PeerDAS has L2s already handling thousands. Full Danksharding, Verkle Trees, and ZK proving at scale get you to tens of thousands of TPS across the combined system, but that’s 2028-2029 territory.

Verkle Trees: not this year

Verkle Trees are the upgrade that could eventually let anyone run an Ethereum validator on a phone. Today, a full node needs to store over 1 TB of state data. Verkle Trees would allow stateless clients that validate blocks using small cryptographic witnesses instead of storing everything locally. The hardware barrier drops dramatically.

The math is clever. Current Merkle Patricia Tries require long proof paths with many intermediate hashes. Verkle Trees are flatter and use polynomial commitments that produce proofs of fixed size regardless of how much data they cover. One proof can verify thousands of state values at the same cost as one.

The ethereum.org roadmap page, updated in August 2025, noted there are “still substantial outstanding updates to clients required to support Verkle trees.” Some sources suggest Hegotá, others 2027. Don’t treat Verkle Trees as a firm 2026 deliverable. It’s coming. Just not on a confirmed schedule.

ETH and the upgrade narrative

ETH is trading around $1,960 as of February 2026, down from above $3,500 at the start of the year and underperforming BTC through the pullback.

Historical upgrade cycles follow a pattern. ETH gained around 60% ahead of Dencun in Q1 2024. Shapella in April 2023, which the market feared would trigger mass sell pressure from unstaked ETH, instead saw a 10% rally post-upgrade. The pattern is buy the rumor, sell the news, but the run-up is real.

Whether Glamsterdam follows that script is hard to predict in the current macro environment. Anthony Scaramucci put the institutional dynamics plainly: “I think what happens when institutions come in, they’re probably going to buy the oldest asset. And so it’s Bitcoin.”

That preference for BTC over ETH during risk-off periods has been consistent. Ethereum has the better technical roadmap and more active development than any other L1. Whether that translates to price performance in 2026 depends on whether the macro environment cooperates, and whether the Glamsterdam narrative catches on early enough to build pre-fork momentum.

The upgrades are real. The engineering is solid. The timeline is uncertain. That’s where Ethereum is right now.

Sources: Ethereum Foundation, CoinTelegraph, CoinDesk, Ethereum Magicians forums, Vitalik Buterin. Roadmap status as of February 17, 2026.